Allegations of Mortgage Fraud: Comparing Treasury Secretary Scott Bessent and Fed Governor Lisa Cook

Introduction

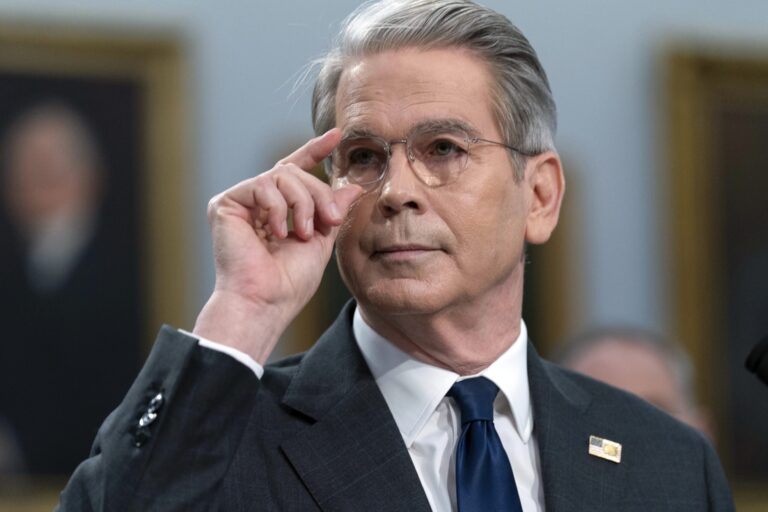

In recent political discourse, allegations of mortgage fraud have surfaced involving high-ranking officials, including Treasury Secretary Scott Bessent and Federal Reserve Governor Lisa Cook. These claims have stirred controversy, particularly as former President Trump has made efforts to oust Ms. Cook from her position at the Federal Reserve. This article delves into the details surrounding these allegations and their implications for both individuals.

Understanding Mortgage Fraud Allegations

What Constitutes Mortgage Fraud?

Mortgage fraud typically involves misrepresentations made during the mortgage application process. Common forms can include:

- Falsifying income

- Misstating occupancy status

- Engaging in deceitful practices to obtain better loan terms

In both Bessent’s and Cook’s cases, questions arise around their declared principal residences, which could suggest discrepancies in their mortgage paperwork.

Scott Bessent’s Case: Dual Principal Residences

Key Details

- Multiple Mortgages: In 2007, Scott Bessent had mortgage documents indicating principal residences in both New York and Massachusetts simultaneously.

- Legal Representation: Bessent did not personally sign the implicated mortgage documents; a lawyer, Charles Rich, executed these on his behalf using power of attorney.

- Lender Awareness: Bank of America, which issued the mortgages, was reportedly aware that Bessent would not inhabit both homes full-time.

Statement from Charles Rich

Rich emphasized the legality of Bessent’s mortgage applications, stating:

“There was absolutely nothing improper about Mr. Bessent’s loan applications with which he was minimally involved.”

This statement aims to clarify the situation and alleviate concerns regarding fraudulent intent.

Lisa Cook’s Mortgage Situation

Double Occupancy Documentation

Similar concerns have emerged regarding Lisa Cook:

- Properties Involved: Cook held mortgage documents for a home in Michigan and a condo in Atlanta in 2021.

- Lender’s Intent: The lender for Cook’s Atlanta property did not expect her to reside there full-time, labeling it as a vacation home.

Trump’s Allegations

Former President Trump has publicly accused Ms. Cook of committing mortgage fraud, raising doubts about her qualifications as a Federal Reserve official.

Legal Developments

Court Rulings on Cook’s Position

In a significant legal ruling, a federal appeals court in Washington, D.C., blocked Trump’s attempts to remove Ms. Cook from the Federal Reserve. The court ruled that Trump did not provide her with proper process to contest the fraud allegations.

Ongoing Responsibilities

- Federal Open Market Committee: Ms. Cook will continue her role in setting interest rates, following a district court ruling that favored her stance against Trump.

Public Reactions

Perspectives on Pressure and Integrity

The financial community has reacted strongly to Trump’s accusations, with many expressing concern over potential undue pressure on the Federal Reserve. Scott Bessent commented:

“There are people who think that President Trump is putting undue pressure on the Fed, and those like him who believe that if a Fed official committed mortgage fraud, this should be examined.”

Conclusion

The allegations against both Scott Bessent and Lisa Cook highlight a complex intersection of finance, law, and politics. While both cases bring forth questions about mortgage documentation and integrity, ongoing legal proceedings and external oversight will likely shape their futures. As the discussions continue, the nuances of these situations will be critical in determining accountability and trust within the financial regulatory landscape.

For further insights into mortgage fraud and the legal intricacies surrounding financial allegations, explore resources from reputable sources like The Consumer Financial Protection Bureau and Vanderbilt Mortgage.