Proposal to Ban Congressional Stock Trading Gains Momentum

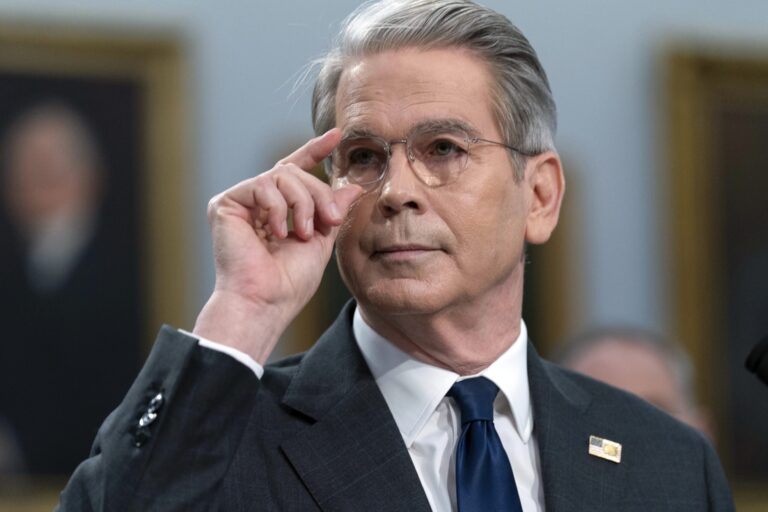

The ongoing debate over congressional stock trading has gained new traction, as Treasury Secretary Scott Bessent emphasizes the transformative potential of legislation aimed at prohibiting such activities. Highlighting the "eye-popping" investment returns achieved by lawmakers, Bessent is advocating for more stringent measures to regulate trading among members of Congress.

The Rationale Behind a Trading Ban

In a recent interview with Bloomberg Television, Bessent shared his concerns regarding the implications of congressional investment activities. He warned that these practices could jeopardize the credibility of both the House and the Senate, claiming that “people shouldn’t come to Washington to get rich; they should come to serve the American people.”

A Closer Look at Troubling Trades

Bessent pointed specifically to the significant investment gains of Representative Nancy Pelosi and Senator Ron Wyden. He remarked, “Every hedge fund would be jealous of them,” spotlighting the glaring discrepancies in investment performance compared to ordinary citizens.

- Key Investments:

- Nancy Pelosi: Notable returns have been associated with her family’s investment choices.

- Ron Wyden: Similar successes have raised eyebrows regarding his trading strategies.

Current Legislative Framework

Under the Stop Trading on Congressional Knowledge Act of 2012, lawmakers are prohibited from using non-public information for personal trading. However, critics argue that this law has not effectively curtailed unethical trading practices.

- Current Limitations:

- Lawmakers must disclose trades over $1,000 within 45 days.

- Inconsistent enforcement and minimal penalties leave much to be desired.

Recent Violations

In the last year, at least ten lawmakers from both parties have been found to violate these disclosure requirements, which raises questions about accountability.

The Paul Pelosi Controversy

A focal point in the discussion has been Paul Pelosi, husband of former House Speaker Nancy Pelosi. His trading activities reportedly yielded an estimated 54 percent return in 2024, far surpassing the S&P 500 and many major hedge funds. Such exceptional performance has led to the creation of an automated investment fund, the "Pelosi Tracker," designed to replicate his trades.

- Accusations of Insider Trading: President Trump has suggested that the Pelosis are leveraging “inside information” to eclipse hedge fund returns in 2024.

Nancy Pelosi has consistently denied any involvement in her husband’s trading decisions, defending lawmakers’ rights to engage in a free market economy.

Renewed Legislative Efforts

The urgency of reform is underscored by incidents from 2020, during which some lawmakers faced scrutiny for trading on information gathered during COVID-19 briefings. Although investigations by the Department of Justice ultimately yielded no charges, the incident amplified public interest in legislative reform.

The PELOSI Act

Recently, concrete steps toward legislative action have emerged. The Senate Homeland Security and Governmental Affairs Committee has advanced a proposal known as the PELOSI Act. This legislation aims to ban lawmakers and their spouses from trading individual stocks while in office, extending similar restrictions to presidents and vice presidents, though it would not affect President Trump until the start of his next term.

Statements from Legislators

Senator Josh Hawley, who introduced the PELOSI Act, articulated the frustration many Americans feel, stating, “Americans have watched politicians earn a fortune using information not available to the general public while the average family struggles to get by. It’s just wrong.”

- Key Points of the PELOSI Act:

- Prohibition of individual stock trades by lawmakers and their spouses.

- Expansion of restrictions to the highest levels of government.

Conclusion

As the call for reform intensifies, the conversation surrounding congressional stock trading remains a topic of crucial importance. The emergence of the PELOSI Act could signify a monumental shift in how lawmakers are allowed to engage with the market. With growing public concern over the ethical implications of trading by elected officials, the momentum for reform appears stronger than ever.

For further reading on financial ethics in politics, check out the work of the SEC and additional resources on congressional trading laws.