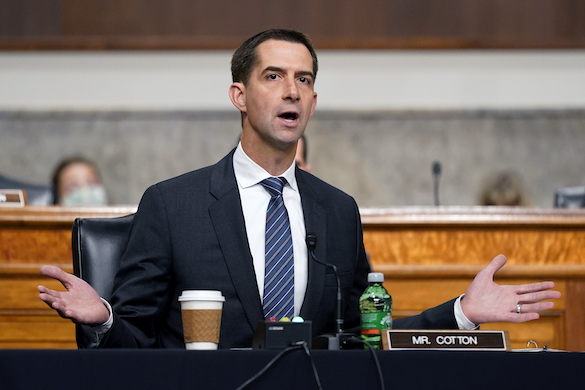

Senator Tom Cotton Calls for IRS Investigation into CAIR

Introduction

Republican Senator Tom Cotton is urging the Internal Revenue Service (IRS) to launch an investigation into the Council on American-Islamic Relations (CAIR) for potential violations of its tax-exempt status. He points to alleged connections between CAIR and terror organizations, stating that such affiliations warrant scrutiny from federal authorities.

Allegations Against CAIR

In a letter addressed to IRS Commissioner Billy Long, Cotton highlighted purported ties between CAIR and various groups, including Hamas and the Muslim Brotherhood. This call for investigation comes in the wake of renewed concerns regarding CAIR’s activities, particularly following the attacks by Hamas on October 7.

Key Points in Senator Cotton’s Letter

-

Tax-Exempt Status: Cotton emphasized in his letter that "tax-exempt status is a privilege, not a right." He argues that organizations with links to terrorism should not benefit from tax exemptions meant for charitable entities.

-

Historical Context: CAIR has been under scrutiny for years, previously labeled as an unindicted co-conspirator in a significant federal terrorism financing case in 2009. At that time, several of CAIR’s founders had ties to Hamas supporters during a Philadelphia meeting, where strategies to promote an Islamist agenda in America were allegedly discussed.

- Immediate Action Required: Cotton requested the IRS to conduct a comprehensive examination of CAIR’s financial records, affiliations, and operations to ensure compliance with IRS Section 501(c)(3), which sets forth the requirements for nonprofit organizations.

CAIR’s Controversial Statements and Actions

Since the October 7 attacks, CAIR has drawn further criticism. Nihad Awad, the Executive Director of CAIR, made comments in support of Palestinian self-defense, which many interpreted as controversial given the ongoing violence. His statements have led to:

-

Severed Ties: The Biden administration has distanced itself from CAIR, having previously engaged the organization in initiatives to combat anti-Semitism.

- Ongoing Scrutiny: Organizations such as the Anti-Defamation League have accused CAIR of being "openly antisemitic and anti-Zionist." They claim that Awad has connections with the Muslim Brotherhood and has engaged with individuals linked to terrorist organizations.

Key Quotes from Senator Cotton

In his correspondence with the IRS, Cotton stated:

“CAIR purports to be a civil rights organization dedicated to protecting the rights of American Muslims. But substantial evidence confirms CAIR has deep ties to terrorist organizations.”

The Need for Compliance

Senator Cotton highlighted the significance of compliance for nonprofit entities, stressing that they must operate:

- Exclusively for charitable, educational, or religious purposes

- Without providing material support to terrorism

Given the serious nature of the allegations against CAIR, the senator’s call for an investigation signals a critical moment in the examination of the organization’s operations.

Conclusion

As the IRS faces pressure to scrutinize CAIR, the implications surrounding its tax-exempt status could have lasting effects on the organization and its future activities. The ongoing debate continues to spotlight the intricacies of national security and the complexities of civil rights advocacy within the United States.

For more information about CAIR and related matters, visit The Washington Free Beacon and the Anti-Defamation League.